Take time to review where you are and then use your budget to create a road map to where you want to be. Instead, it’s a reflection of your priorities and goals. Your monthly budget isn’t a millstone dragging you down.

Monthly budget planning how to#

For example, if paying down debt was one of your budget priorities and now you’re debt-free, you’ll need to reevaluate your situation and determine what to tackle next and how to allocate your newly available money.

Monthly budget planning free#

Feel free to adjust as your priorities change.Ĭonsider reviewing your monthly budget each year to see if you need to make a major overhaul. After following it for a few months, you might discover that you need to allocate more money to one category and less to another. Your budget doesn’t have to be set in stone. Go through your list of priorities and budget categories and assign dollar amounts to each based on when you’re paid. Set up automatic transfers from your checking account to those subaccounts on a regular schedule that reflects when you receive income and pay your other bills. Many bank accounts allow you to use subaccounts to save for specific purposes, such as a vacation or a down payment on a home. Perhaps you go grocery shopping once a week to match up with your pay schedule-and to help you avoid wasting food. When possible, attempt to divide expenses in a way that allows you to have a smoother month. When do your income sources hit your bank account? How do those line up with the due dates on your bills? Now we get to the meat of setting a monthly budget. Take this opportunity to cut unimportant things from your budget. You may realize you’ve been throwing money away on things that don’t matter to you. Compare your priorities with what you’ve been spending your money on. Don’t forget to put needs like housing, groceries, insurance, and utilities near the top of the list.īy listing your priorities, you’re more likely to make a monthly budget you can stick to, and one that doesn’t feel like deprivation. Rank them, starting by “paying yourself first” by allocating money toward retirement and emergency savings. Do you want to pay down debt? Save up for a vacation? Put money aside for retirement?Īll these priorities are important-but some matter to you more than others. You might be surprised to discover how much you’re spending at certain stores or in different categories.

If you’re using a calendar as a visual aid-or if you’ve plugged your income and expenses into a budget spreadsheet-use different colors for expenses and income items.Ī spending review like this can be an eye-opener. Decide how each expenditure fits within your budget categories.Use highlighters in different colors to identify categories and add up how much you usually spend on each category.These might include utilities, groceries, gas, travel, entertainment, clothing, and personal care. Think about common budget categories you’re likely to spend money on.

Monthly budget planning download#

Download and review your bank and credit card statements for the last two or three months, then: When setting a monthly budget, you should know how you’ve been spending your money. Once you know how much is coming in, you’ll be better prepared to make decisions about where that money should go-and you’ll know exactly what you’re working with. Green is a good color for denoting paydays. A calendar can help you visualize the dates you expect to receive money. Consider designating one day each month as your “payday” for budgeting purposes. Variable or irregular income sources? List these using an average amount you can expect each month based on the previous year’s income.Also, if you receive regular payments from a pension, trust, or other source, list those as well. Job and other steady income sources? List your paydays and how much is deposited into your bank account.

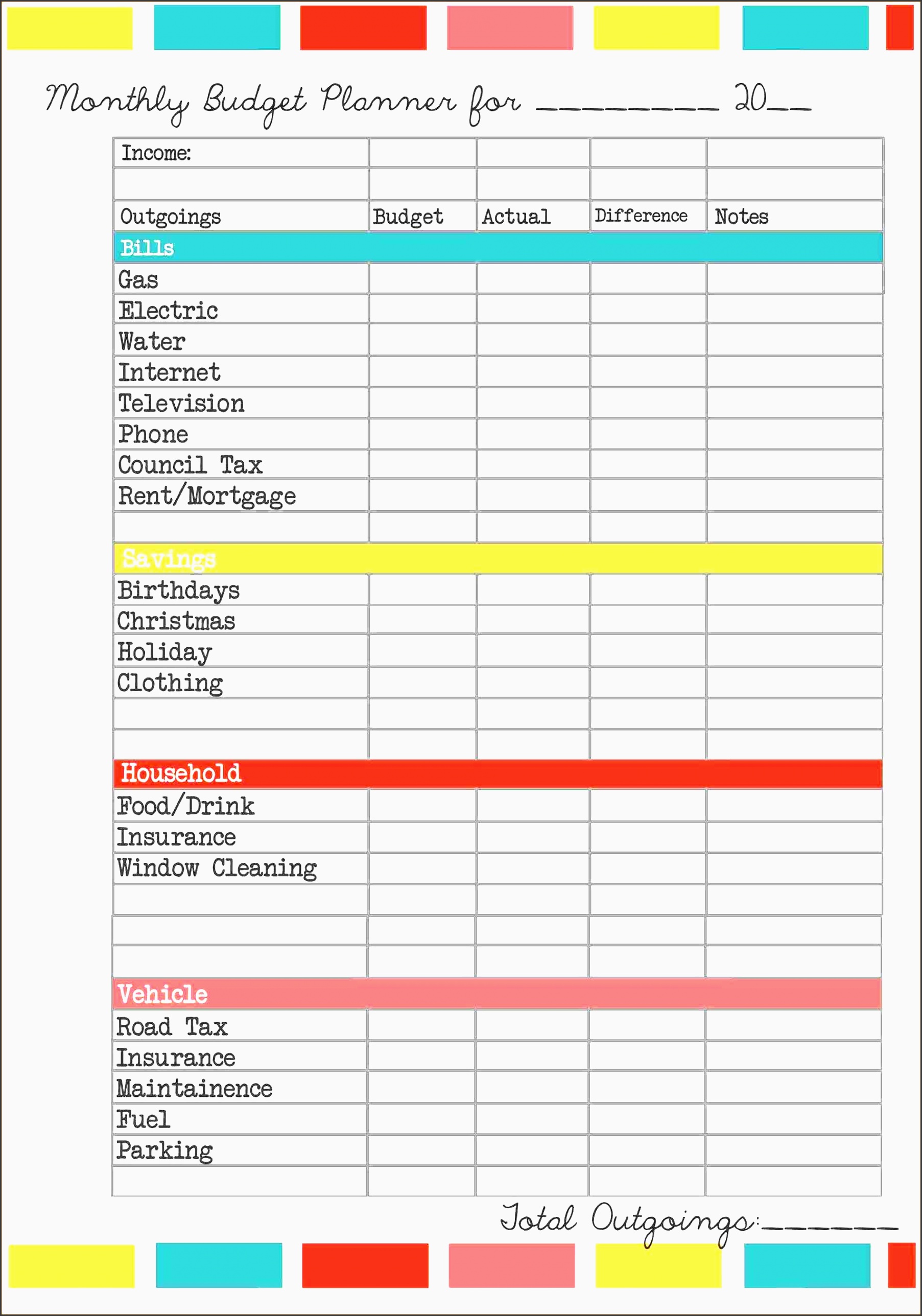

Write down how much you receive and the dates you expect to get paid. Here are some practical steps to make a monthly budget. Your monthly budget planner sets the tone for your money-and helps ensure your priorities are taken care of. With a budget, you can get a better idea of how each dollar should be used to make the most of your income. It lets you see where you are in your journey and helps you reach your next destination. Think of your budget as a road map for your money.

0 kommentar(er)

0 kommentar(er)